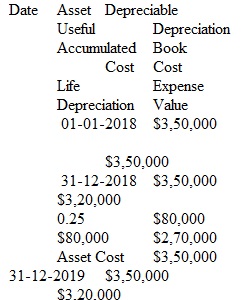

Q General Instructions Before you begin this assignment, please make sure you read thoroughly through the General Instructions for Excel. This will give you directions on how the assignment is to be prepared. Please note that I use the term "Excel" the same way I use the term Band-Aid or Kleenex. These are product names for spreadsheet programs, bandages, and facial tissue. In the general instructions for Excel assignments, I make it clear that you don't have to use Excel specifically, any spreadsheet program will do as long as you save your file with an xls or xlsx extension. Excel Assignment #1 On January 1, 2018, Friendly Farm Company purchased a new machine at a cost of $350,000. The machine has an estimated useful life of 4 years or 100,000 hours and residual value of $30,000. The machine will be used 30,000 hours in year one, 40,000 hours in year two, 20,000 hours in year 3, and 10,000 hours in year 4. Requirements: Prepare a depreciation schedule using each of the three methods: Straight line, Units of Production, and Double Declining Balance. You may use the template Download template I have attached here or you may create your own depreciation schedules using your textbook as a guideline. Examples can be found on pages 547-549. Do all mathematical computations in Excel when you can. Don’t use a calculator and “type” the number in. That’s not letting the spreadsheet do the work. If you need more help with Excel you have access to an e-book included with your access in your MyLab and Mastering Course Home. Or use YouTube to access a ton of videos of how-to videos on Excel. Speaking of videos, here's one I recorded about this assignment in particular. Please note: it was brought to my attention by one of your colleagues that this video contains an error (sorry). At approximately the 1:52 mark I type in the first year of depreciation, but the date is incorrect. It should be 12/31/18 instead of 1/31/18. Sorry for any confusion. Why I Am a Stickler Regarding Using Excel Properly For those of you who may be thinking I’m a real stickler for using formulas and cell addresses when you can in Excel assignments, rest assured, there’s a reason for this. Your spreadsheet is really a powerful tool. One of Excel's most powerful features is the ability to do “what-if analysis”. It means just what it says, it gives you the ability to change the data in the cells and see what the results will be. It also gives you the ability to change data based on new results. That ability is hampered when you type in a number when you could have used a formula or a cell address. I know this first hand. Back in the day when I was working in industry, I made the mistake of typing in some values into a spreadsheet. We called it “hard coding” the spreadsheet. It was a budget forecast and my results were impaired because of this. I didn’t lose my job, but I was definitely called on the carpet for this and my credibility was strained for quite a while. This is a lesson I want you to learn in a safe place. Losing a point or two is preferable to losing a job or losing face. That’s why I am tough on you when it comes to using formulas and cell addresses. Rubric Excel Rubric Excel Rubric Criteria Ratings Pts This criterion is linked to a Learning OutcomeExcel Work 10 to >9.0 pts Excellent Use of excel formulas to do all mathematical calculations. Appropriate use of underlines, double underlines. No misspellings. Appropriate rounding. 9 to >7.0 pts Good Mostly uses formulas to do mathematical calculations. Slight misspelling, rounding error and/or formatting issues. 7 to >6.0 pts Average Uses some formulas but not more than half. More than three misspellings. More than one formatting issues. No underlines used. 6 to >0 pts Below Average Uses no formulas, types in numbers. Or types in numbers and add them together. Several misspellings, formatting sloppy. 10 pts This criterion is linked to a Learning OutcomeAccounting Understanding 10 to >9.0 pts Excellent Strong understanding of the underlying issues in solving the accounting problem. Answer is correct. 9 to >7.0 pts Good Decent understanding of the accounting issues being presented. Answer is mostly correct. 7 to >6.0 pts Average Decent understanding of the accounting issues being presented. Answer is at least 70% correct. 6 to >0 pts Below Average Incomplete understanding of the accounting issues. More than half the answer is incorrect. 10 pts Total Points: 20 PreviousNext

View Related Questions